Executive Summary: UK Marketing Leadership Insights 2025

As we navigate through 2025, our comprehensive market analysis reveals fascinating shifts in the UK marketing leadership landscape. Our latest survey, encompassing feedback from hundreds of senior marketing leaders, presents compelling insights into the evolving dynamics of our industry.

Key Findings

The data reveals several critical trends shaping our sector:

Strategic Challenges

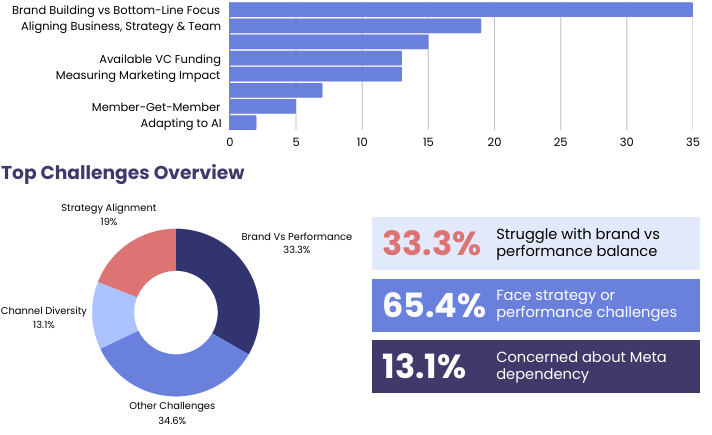

- 33.3% of leaders cite balancing brand building with commercial performance as their primary challenge.

- 19% struggle with aligning business strategy across distributed teams.

- 13.1% are focused on reducing Meta dependency through channel diversification.

Workforce Trends

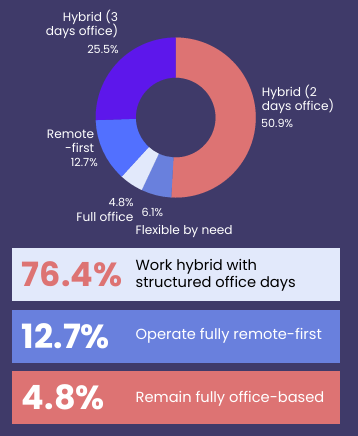

- 76.4% of companies now offer structured hybrid working.

- The dominant model (50.9%) is two office days per week.

- Only 4.8% maintain traditional full-office arrangements.

Compensation & Benefits

- Location differentials remain significant, with London commanding a +15% premium.

- Company size heavily influences packages, with enterprise-scale companies (£500M+ revenue) offering +25% above baseline.

- 72% of candidates have declined roles due to inadequate benefits packages – up from 65% in 2024.

Movement & Retention

- 51.2% of marketing leaders are considering role changes in 2025.

- 47.6% cite new challenges as their primary motivation for moving.

- 75.9% express satisfaction with current roles, yet remain open to opportunities.

Looking Forward

The marketing leadership landscape isexperiencing unprecedented change. Leaders must navigate increasing regulatory pressures, evolving workforce expectations, and the continuous drive for commercial performance while building sustainable brand value.

Our data suggests successful organisations in 2025 will be those that:

- Embrace flexible working as a standard, not a benefit.

- Offer comprehensive benefits packages beyond base salary.

- Provide clear growth and development opportunities.

- Balance commercial performance with long term brand building.

Support for Your Organisation

For a comprehensive breakdown of current market rates, benchmarking data, and detailed insights into benefits and equity structures, please reach out to our team. Our extensive database and market intelligence can help ensure your organisation remains competitive in this dynamic landscape.

Digital Marketing Leadership Challenges 2025

Our latest survey of digital marketing leaders reveals fascinating insights into the challenges shaping the industry in 2025. Clear patterns emerge about the critical issues facing marketing leadership today.

The Brand-Performance Balancing Act

The most significant challenge, cited by 33.3% of respondents, is balancing brand building with bottom-line focus. This is not surprising in today’s economic climate. Marketing leaders are under increasing pressure to deliver immediate commercial results whilst simultaneously building long-term brand value – a challenge that is particularly acute in high-growth environments.

The data suggests this tension is most pronounced in scale-up businesses, where the need for rapid growth often conflicts with sustainable brand development. Marketing leaders must navigate these competing demands whilst maintaining clear strategic direction.

Strategy-Execution Alignment

The second most pressing challenge, highlighted by 19% of respondents, is aligning business strategy, product, and team. This speaks to the increasingly complex nature of modern marketing organisations, where leaders must coordinate multiple stakeholders across various functions.

This challenge is particularly noteworthy given the rise of hybrid working models. With teams increasingly distributed, ensuring strategic alignment requires innovative approaches to communication and collaboration.

The Meta Dependency Dilemma

Channel diversification and reducing reliance on Meta emerges as the third most significant chalenge, with 13.1% of leaders citing this as their primary concern.

This reflects growing unease about platform dependency and the need for more resilient marketing strategies.

Marketing leaders are grappling with how to maintain performance whilst building more sustainable, diverse channel strategies. This chalenge is compounded by the constant evolution of digital platforms and changing consumer behaviours.

Investment and Impact

Two chalenges share fourth place, each cited by 11.9% of respondents:

- Lack of available VC funding.

- Measuring and demonstrating marketing impact.

These related challenges speak to the increasing pressure on marketing leaders to justify investment and demonstrate clear returns. In a tightening funding environment, the ability to prove

marketing’s impact becomes even more crucial.

The Omnichannel Evolution

Navigating the rise of omnichannel and evolving D2C landscape concerns 6% of leaders. While this might seem surprisingly low, it reflects that many organisations have already adapted to omnichannel operations. The challenge now lies in optimisation rather than initial adoption.

Emerging Challenges

Interestingly, only 3.6% cite viral marketing and member-get-member strategies as their primary challenge, suggesting these tactics may be becoming less central to marketing strategy. Even more notably, just 1.2% identify adapting to AI as their main challenge, indicating that AI integration is now seen as an enabler rather than a challenge.

Primary Challenges Distribution

Looking Forward

These findings suggest several key priorities for marketing leaders in 2025:

- Develop Balanced Metrics Focus on creating measurement frameworks that value both short-term performance and long-term brand building.

- Strengthen Alignment Invest in tools and processes that enhance strategic alignment across distributed teams.

- Build Channel Resilience Create more diverse channel strategies while maintaining performance.

- Improve Impact Measurement Develop more sophisticated approaches to demonstrating marketing’s business impact.

Marketing leaders who can effectively address these challenges whilst maintaining strategic focus will be best positioned for success in 2025’s complex landscape. The key lies not in choosing between competing priorities, but in finding innovative ways to address multiple challenges simultaneously.

The data clearly shows that modern marketing leadership requires a sophisticated approach to balancing multiple pressures. Success will come to those who can maintain this balance while driving both commercial results and long-term brand value.

The question is that for those who achieve results – how will they be rewarded?

Marketing Leadership Hiring Trends 2025: A Shift Towards Strategic Growth

As we analyse the latest data from our comprehensive UK marketing leadership survey, fascinating patterns emerge in how organisations are approaching team management and hiring in 2025. Against a backdrop of significant regulatory changes and economic pressures, marketing leaders are demonstrating remarkable adaptability in their approach to team building and management.

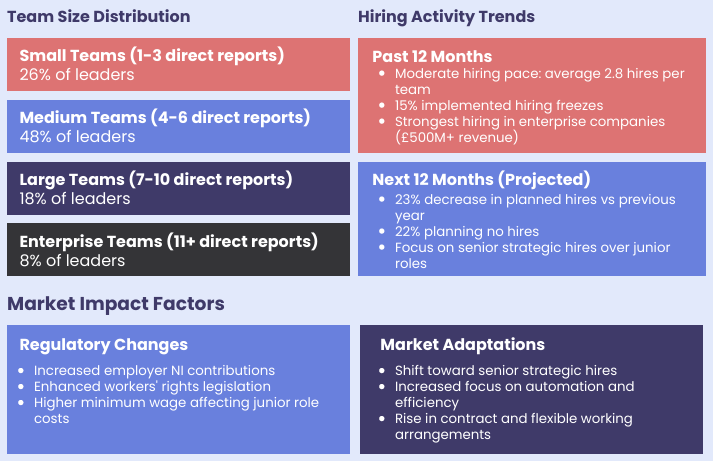

Current Team Structures Show Strategic Consolidation

The landscape of marketing team management has evolved considerably. Our data reveals that nearly half of marketing leaders now manage medium-sized teams of 4-6 direct reports, representing a shift towards more focused, efficient team structures. This marks a notable change from the larger team structures we have seen in previous years.

Particularly interesting is the small proportion (8%) managing enterprise-level teams of eleven or more people. This suggests a broader trend towards leaner, more agile team structures, even within larger organisations.

Historical Hiring Patterns Paint a Complex Picture

Looking back at the past 12 months, we have seen moderate hiring activity across the sector. However, the distribution has not been uniformed:

- Enterprise companies (particularly those with £500M+ revenue) have maintained the strongest hiring momentum.

- Smaller organisations have shown more caution, with approximately 15% implementing hiring freezes.

- Average hiring across all company sizes showed modest growth, though significantly lower than pre-pandemic levels.

Future Outlook: Strategic Over Volume

Perhaps most telling is the outlook for the next 12 months. We are seeing a clear shift in hiring strategies, with a projected decrease in overall hiring volume compared to the previous year. However, this does not tell the whole story.

Marketing leaders are showing a clear preference for strategic, senior-level hires over junior positions. This shift is driven by several factors:

- Increased employment costs due to regulatory changes.

- A focus on experienced professionals who can manage broader remits.

- The need for strategic expertise in an increasingly complex market.

Market Forces Shaping the Landscape

The current hiring landscape is being significantly influenced by several key market forces:

Regulatory Impact

The introduction of increased employer National Insurance contributions and enhanced workers’ rights legislation has made hiring more complex and costly. The substantial rise in minimum wage (to £11.44 from April 2024) has particularly impacted entry-level recruitment decisions.

Economic Pressures

Ongoing inflation and cost-of-living pressures continue to influence both hiring decisions and salary negotiations. This has led to a more measured approach to team expansion, with organisations focusing on essential hires that can demonstrate clear ROI.

Structural Adaptations

Organisations are responding to these challenges through various strategies:

- Increased investment in automation and efficiency tools.

- Greater emphasis on flexible working arrangements.

- Focus on upskilling existing team members.

- Preference for multi-skilled marketers who can manage diverse responsibilities.

Current Team Management Trends

Looking Ahead

As we progress through 2025, marketing leaders are adapting their hiring and management strategies to navigate a complex landscape. The focus has shifted from team expansion to strategic growth, with an emphasis on efficiency and productivity improvements to manage increased employment costs.

While hiring has not stopped, it has become more strategic and targeted. Organisations are carefully considering each new hire’s potential impact and looking for ways to maximise the effectiveness of existing teams through technology and upskilling.

Key Takeaways for Marketing Leaders:

- Focus on strategic hires that can deliver immediate impact.

- Invest in technology and automation to improve team efficiency.

- Consider flexible working arrangements to attract and retain top talent.

- Prioritise upskilling existing team members.

- Look for opportunities to consolidate roles and responsibilities.

The marketing landscape continues to evolve, and successful leaders will be those who can balance the need for growth with operational efficiency while navigating increasing employment costs and regulatory requirements.

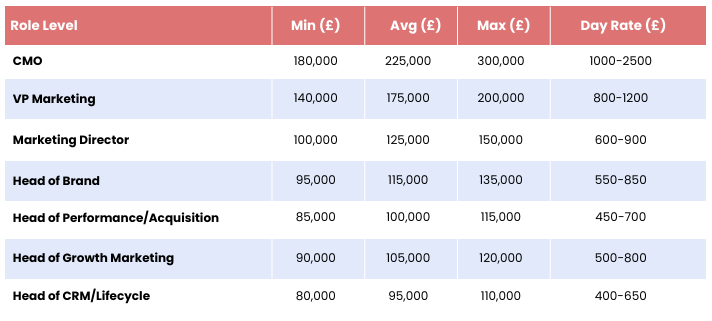

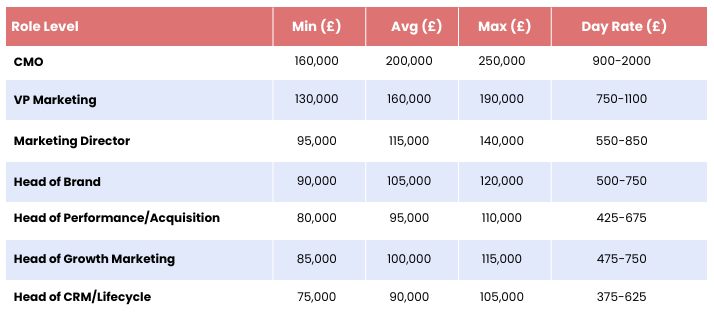

Salary Survey

DTC/Consumer

FinTech

Marketplace

Notes:

- All figures in GBP (£)

- Permanent salaries are base compensation only, excluding bonuses and benefits.

- Day rates are for contract positions and exclude VAT.

- London-based roles typically command a 10-15% premium.

- Ranges may vary based on company size, funding stage, and individual experience.

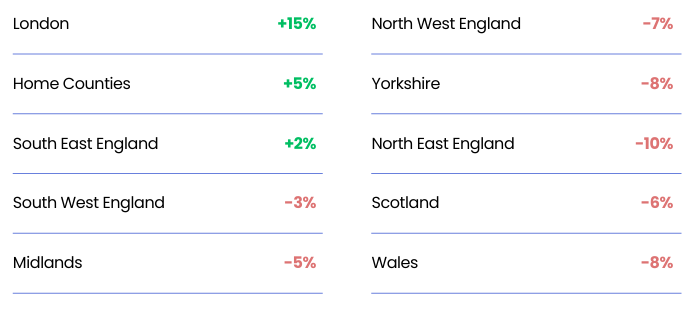

Location Based Salary Differentials

Company Revenue-based Salary Differentials

A few key observations:

Location-based differentials:

- London commands the highest premium at +15% above base.

- There is a clear declining gradient as you move away from London and the South East.

- Regional variations can result in up to a 23% difference between London and Wales.

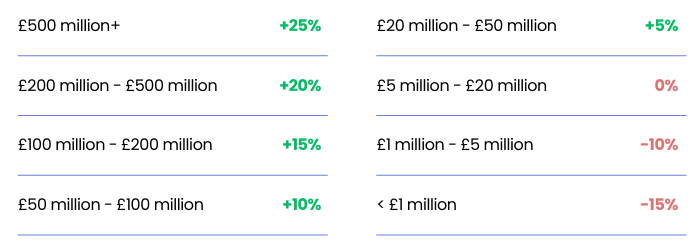

Revenue-based differentials:

- Enterprise-scale companies (£500M+) offer the highest premiums at +25%.

- Mid-market companies (£20M-£50M) offer modest premiums around +5%.

- The smallest companies (<£1M) typically pay 15% below the baseline.

Some context on these figures:

- The differentials are calculated against the baseline salary figures in the original table.

- These are average figures – individual packages can vary significantly based on specific companies and roles.

- Cities within these regions (like Edinburgh in Scotland or Leeds in Yorkshire) might command higher salaries than the regional average.

- The growing trend of remote work is gradually starting to flatten some of these regional differences.

Benefits Analysis

HYBRID WORKING: FROM PERK TO EXPECTATION

The digital marketing sector has witnessed a remarkable shift in how hybrid working is perceived. While 76.4% of companies now offer structured hybrid arrangements, there is a fascinating divide in how this is positioned within the employment package.

For many organisations, hybrid working has transitioned from a distinctive benefit to a fundamental expectation. The predominant model (50.9%) involves two office days per week, with a further 25.5% operating on a three-day office pattern. Only 4.8% of companies maintain traditional full-office models, highlighting the scale of this transformation.

Most telling is that companies still operating traditional office-only models face significant recruitment challenges. With 84% of marketing professionals open to new opportunities and workplace flexibility ranking high in decision making, organisations must recognise that hybrid working is no longer a differentiator – it is a necessity for staying competitive in the talent market.

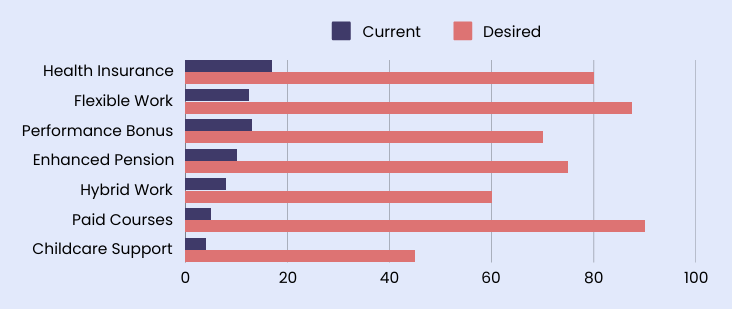

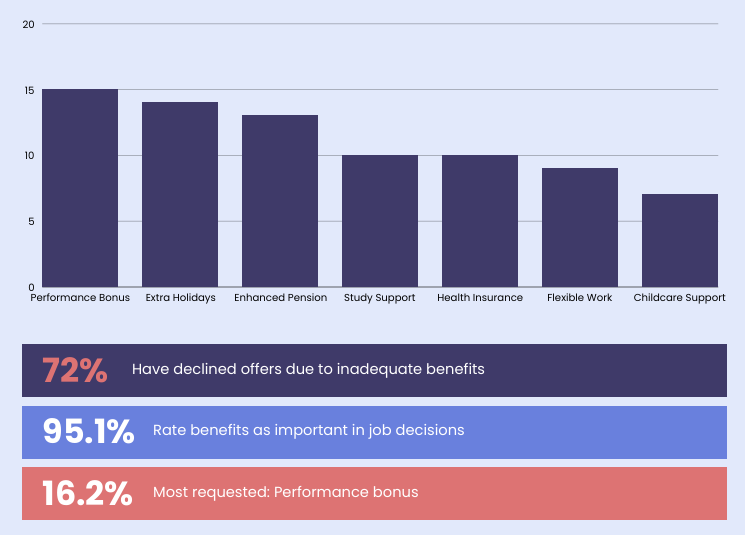

The 2025 survey reveals significant gaps between benefits currently offered and those desired by digital marketing professionals. Health insurance leads current offerings (15.4%), while performance bonuses top the wish list (16.2%). This disconnect highlights opportunities for employers to realign their benefits packages with employee preferences.

The data shows notable gaps between supply and demand:

- Performance bonuses: 12.7% offer vs 70% want.

- Extra holiday: Not prominently offered vs 14% desire.

- Study support: 5.2% offer vs 95% wanting access.

Well-aligned benefits include:

- Health insurance: 15.4% offer vs 9.9% want.

- Flexible working: 12.9% offer vs 9.6% want.

- Childcare resources: Similarly low levels of provision and demand.

Most striking is that 72% of candidates report declining job offers due to inadequate benefits packages – up from 65% in 2024. This underscores the critical importance of benefits in talent attraction, with 95.1% rating benefits as either ‘very important’ (60.16%) or ‘quite important’ (34.96%) when evaluating job offers.

The absence of widely offered performance related benefits, despite being most requested (16.2%), suggests companies could better align reward with achievement. This gap between desired and offered benefits presents clear opportunities for employers to differentiate their packages in a competitive talent market.

Current Vs Desired Benefits

Most Desired Additional Benefits

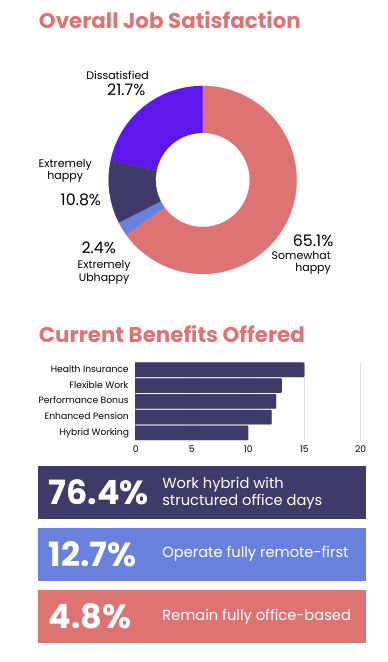

CURRENT SATISFACTION ANALYSIS

Our 2025 survey reveals a nuanced picture of satisfaction levels in the digital marketing sector. While 75.9% of professionals express some level of satisfaction with their current roles (65.1% somewhat happy, 10.8% extremely happy), there remains a considerable proportion (24.1%) reporting dissatisfaction.

The benefits landscape shows interesting patterns, with health insurance leading current offerings (15.4%), followed by flexible working (12.9%) and performance bonuses (12.7%). However, the relatively low percentage across all benefits suggests room for expansion in benefits packages.

Most telling is that despite positive satisfaction levels, 51.2% remain open to new opportunities, indicating that companies must work harder to retain talent through comprehensive benefits packages and engaging work environments.

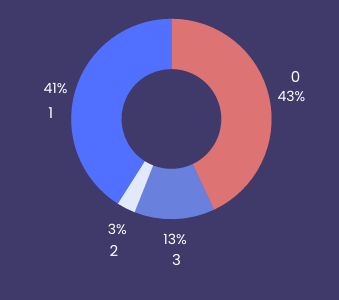

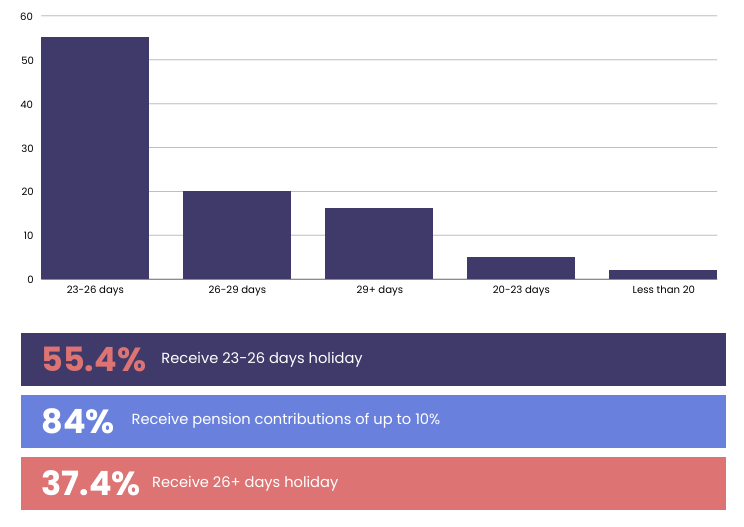

PENSION AND LEAVE PATTERNS

The survey reveals most digital marketing professionals receive standard pension and leave packages. The average holiday entitlement clusters around 23-26 days, with 55.4% of respondents receiving this amount. Only 37.4% receive more generous allowances of 26+ days, with a small proportion (16.9%) receiving 29+ days.

Pension contributions show a clear split: 43% receive basic contributions of 0-5%, while 41% get mid-tier 5-10% packages. Only 3% receive contributions above 10%, suggesting few employers offer premium pension benefits. Notably, 13% do not know their contribution rates, indicating potential communication gaps.

The data indicates most employers meet market standards but rarely exceed them. With 84% offering up to 10% pension contributions, there’s scope for companies to differentiate through enhanced retirement benefits. The clustering of holiday allowance around 23-26 days suggests similar standardisation in leave benefits.

Overall Job Satisfaction

Holiday Allowance Distribution

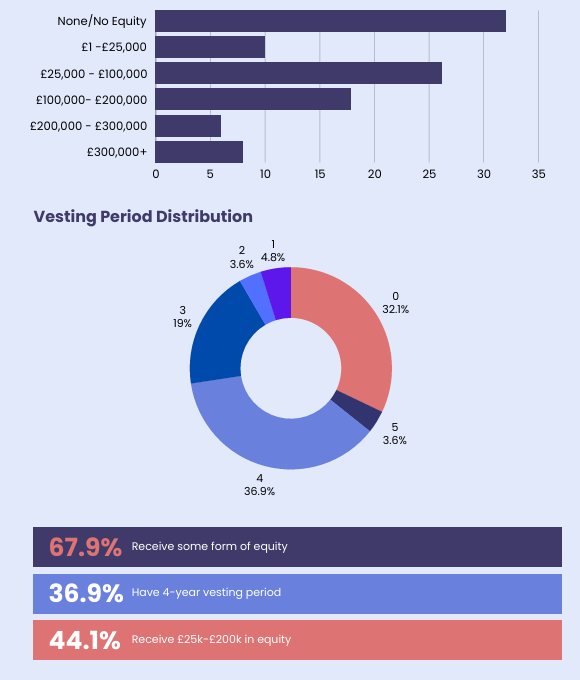

EQUITY DISTRIBUTION & RETENTION IMPACT

The survey reveals fascinating patterns in how digital marketing firms use equity to secure and retain top talent. Whilst a third of professionals (32.1%) receive no equity, this leaves a significant majority who are invested in their organisations’ success through share ownership – a powerful retention lever when properly structured.

Value Distribution & Strategic Implications

The most telling pattern emerges in the mid-tier equity bands:

- 26.2% receive £25,000-£100,000.

- 17.9% receive £100,000-£200,000.

- 14.3% receive packages exceeding £200,000.

This clustering around substantial yet not excessive equity grants suggest companies are striking a careful balance between meaningful ownership and sustainable dilution. The £25,000 £200,000 range appears particularly effective, capturing 44.1% of all equity grants.

Vesting Structures as Retention Tools

The dominance of longer vesting periods is particularly noteworthy:

- 36.9% operate on 4-year vesting.

- 19.0% use 3-year terms.

- Only 8.4% opt for shorter periods.

- 3.6% extend beyond 5 years.

This weighting towards longer vesting periods, particularly the 4-year standard, demonstrates sophisticated retention engineering. By stretching equity release over multiple years, organisations

create ‘golden handcuffs’ that encourage longer tenures whilst allowing for value accumulation that rewards loyalty.

Retention Impact

The equity distribution reveals clear strategic thinking:

- Entry-level grants (£1-£25,000) represent just 9.5%, suggesting equity is viewed as a senior retention tool.

- Mid-tier grants dominate, indicating careful calibration of retention incentives.

- Premium packages (£300,000+) are rare (8.3%), preserving their impact for critical retention cases

Companies appear to be using equity strategically rather than universally, with grant sizes that create meaningful wealth creation opportunities without over-diluting shareholding. This targeted approach suggests sophisticated understanding of equity’s retention power.

Future Considerations

For organisations reviewing their equity strategies:

- Consider implementing longer vesting periods with interim milestones.

- Structure grants large enough to create meaningful wealth opportunities.

- Balance retention needs against dilution through careful grant sizing.

- Use equity as part of a broader retention strategy including career development and work-life balance.

The data suggests that whilst equity remains a powerful retention tool, its effectiveness depends heavily on thoughtful structuring and sizing. Organisations would do well to consider whether their equity programmes reflect these market patterns or risk misaligning with employee expectations.

Equity Value Distribution

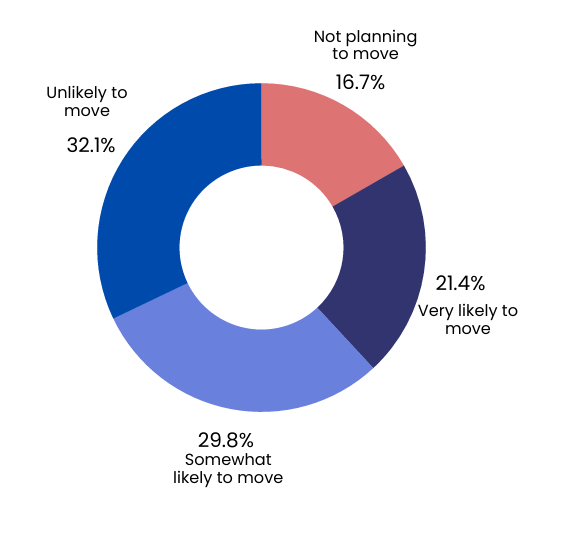

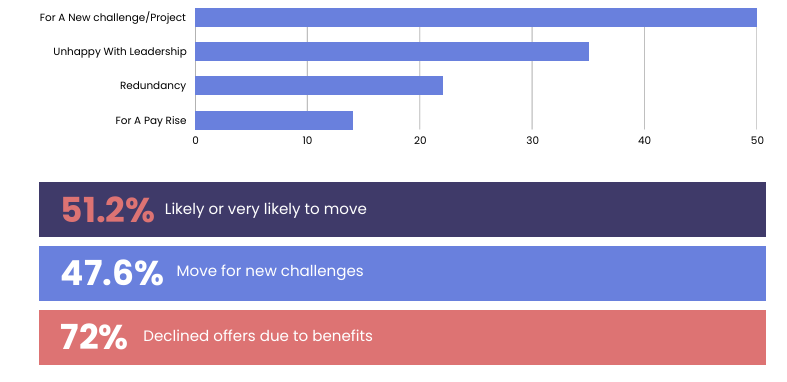

MOVEMENT INTENTIONS AND MOTIVATIONS 2025

Our survey reveals a digital marketing workforce poised for significant movement in 2025, with 51.2% of professionals either likely or very likely to change roles. This high proportion of potential movement occurs despite 75.9% expressing some level of satisfaction with their current positions, suggesting that contentment alone is not enough to ensure retention.

Movement Drivers

The reasons for job changes show fascinating patterns:

- New challenges/projects lead at 47.6%.

- Leadership dissatisfaction drives 34.5% of moves,

- Redundancy accounts for 26.2%.

- Pay rises motivate only 14.3% of moves.

Most telling is that whilst only 14.3% cite salary as their primary reason for moving, 72% report declining job offers due to inadequate benefits packages. This suggests that whilst salary may not drive initial job searching, it remains a crucial decision factor.

Satisfaction vs Movement

Current satisfaction levels present an interesting paradox:

- 65.1% are “Somewhat Happy”

- 21.7% express dissatisfaction

- 10.8% are “Extremely Happy”

- 2.4% are “Extremely Unhappy”

Yet this high satisfaction does not translate to stability, with over half the workforce open to moves. This disconnect suggests that satisfaction alone is not enough – professionals seek growth, challenge and comprehensive rewards packages.

Benefits Impact

The benefits gap appears particularly crucial:

- 95.1% rate benefits as important in job decisions.

- Health insurance (15.4%) leads current offerings.

- Performance bonuses (16.2%) top the wish list.

- Strategic benefits gaps exist in nearly every category.

Strategic Implications

For organisations seeking to retain talent:

- Focus on creating new challenges and growth opportunities.

- Review leadership effectiveness and communication.

- Ensure benefits packages align with market expectations.

- Consider the total reward proposition beyond base salary.

The data clearly shows that movement intentions in 2025 are driven by a complex mix of factors beyond simple compensation. Organisations must address both professional growth and comprehensive benefits to retain top talent effectively.

Likelihood of Moving Jobs

Reasons for Last Move

Conclusion: Marketing Leadership in 2025 – A Period of Strategic Evolution

Our comprehensive analysis of the UK marketing leadership landscape in 2025 reveals a sector experiencing significant transformation. The data highlights a clear shift towards more strategic, focused approaches to team building and talent retention, driven by both economic pressures and evolving workforce expectations.

Key Conclusions

Market Dynamics

The intersection of increased employment costs, regulatory changes, and shifting workforce expectations has created a complex operating environment. Leaders are responding with more thoughtful, strategic approaches to hiring and team management.

Leadership Priorities

Marketing leaders must now balance multiple competing priorities:

- Short-term performance with long-term brand building.

- Cost efficiency with competitive compensation.

- Team flexibility with organisational alignment.

- Innovation with proven performance.

Future Success Factors

Organisations that will thrive in this environment are those that:

- Embrace the evolution of hybrid working.

- Develop comprehensive, competitive benefits packages Create clear paths for professional development.

- Build resilient, multi-channel marketing strategies.

- Foster strong leadership and communication practices

Looking Forward

As we progress through 2025, success in marketing leadership requires a more nuanced, integrated approach than ever before. The focus must be on creating sustainable, adaptable organisations that can attract and retain top talent while delivering consistent commercial results.

The challenge for leaders will be maintaining this balance while navigating increasing cost pressures and evolving workforce expectations. Those who can effectively combine strategic vision with operational excellence will be best positioned to succeed in this dynamic environment.

For detailed salary benchmarking data, comprehensive benefits analysis, or strategic hiring support, please contact our team. Our extensive market intelligence and industry expertise can help ensure your organisation remains competitive in this evolving landscape.